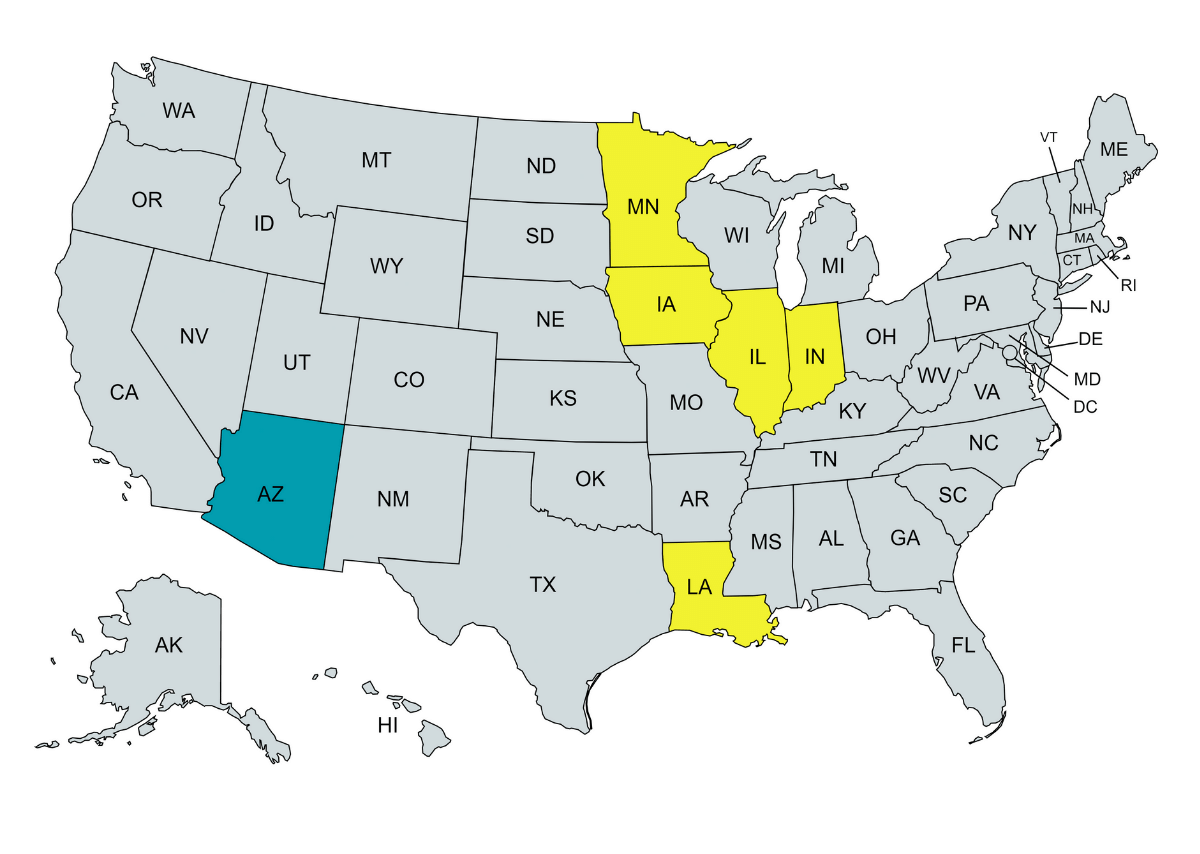

On Federal tax returns, teachers may receive a tax credit for out-of-pocket purchases for their classroom. It would only be fair that you could do the same for purchases of homeschool supplies in your home classroom, right? Unfortunately, as with most tax policy, it isn’t fair. Homeschool supplies are not tax deductible on your federal return, but are homeschool supplies tax deductible on state income taxes? Yes! Some states provide tax deductions for homeschool expenses. Find out if yours is on the list!

State Homeschool Supplies Tax Deductions

Illinois Education Expense Tax Credit

The Education Expense Credit allows up to $750 in non-refundable tax credits for certain education expenses over $250 in the year. Check the linked site for full details. Below is a summary of some key points:

- The credit is 25% of qualified expenses over $250

- Qualified expenses include: Tuition, workbooks or grade books, book rentals, curriculum rentals, and lab supplies.

- Unqualified expenses include: non-consumables (flash cards, maps, etc.), items that remain personal property, and travel expenses.

- You must attach receipts for the expenses to your income tax return.

Indiana Private School/Homeschool Tax Deduction

The Private School/Homeschool Deduction allows a $1,000 deduction for each child attending homeschool or private school. You are eligible for the deduction if you pay for tuition, fees, computer software, textbooks, and homeschool supplies. Purchases of computers and tablets don’t count as homeschool expenses.

Iowa Tuition and Textbook Tax Credit

Starting in 2021, the Textbook and Tax Credit allows 25% of the first $2,000 of qualifying education expenses for each child as a tax credit. Qualifying expenses include education supplies, computers, textbooks, and costs related to some extracurricular activities. Expenses related to religious education are not allowed.

Louisiana School Expense Tax Deduction

The School Expense Deduction allows up to a $5,000 deduction for education expenses for each child attending homeschool. Check the linked site for full details. Below is a summary of some key points:

- Homeschool: Limited to 50% of costs paid per child up to $5,000.

- Qualifying expenses include school uniforms, tuition, fees, textbooks, curricula, instructional materials, and educational supplies.

- You must keep receipts for all expenses claimed.

Minnesota Education Tax Credit and Subtraction

The Education Credit and Subtraction provides either a credit on income tax due or a subtraction (deduction) from taxable income. Check the linked site for full details. Below is a summary of some key points:

- Education Credit: Subject to maximum income threshold starting at $37,500 for 1 or 2 children.

- Education Subtraction: No income threshold and amount varies based on your child’s age.

- Qualifying expenses differ depending on if you’re claiming the credit or subtraction. Here’s more details of example qualifying expenses.

Other Homeschool Funding: Arizona Empowerment Scholarship Account

Starting in the 2022-2023 school year, all families in Arizona are eligible for the expanded Empowerment Scholarship Account (ESA). This means homeschool families are eligible for $6,500 per child per year for education expenses. This is not money applied against your income taxes, but rather a spending account run by the Arizona Department of Education. More details about how the ESA program works are available here.

Wrapping Up

Tax deductions and other support for homeschool supplies are gaining popularity among the states, and hopefully the trend continues in the future. While homeschool isn’t for everyone, making it more affordable will open it up as an option for more families.

I hope this summary has been helpful. The legal aspects around homeschool can be tricky. If you have questions about the homeschool laws and regulations in your state, I probably answered it in my Homeschool Guide. It’s yours for free when you sign up for my newsletter, plus you’ll receive new updates straight to your inbox!

If you have any questions or would like reach me, I’m always available on social media. Find me at the links below!

Note: Nothing in this post is intended to be legal advice. Please contact your local state government agency for more detailed information.